Top 3 Reasons to Hold Bonds in Your Portfolio

After a decline of more than 20% during Pandemic in 2020, the US stock market is again at all time high. While bond yields have been going down since the 1980s. As of April 2021, US 10-year Treasury bond yield is close to 1.5%. Considering average inflation of 2% to 3%, bond investment would lose its purchasing power over time. Furthermore, income from portfolios with a heavy bond allocation would decrease in a low interest rate environment. So why hold bonds in your portfolio? Following are the top three reasons to hold bonds in your portfolio.

1. Bonds Reduce Volatility of Portfolio.

Depending on your risk tolerance, volatility of a portfolio would be an emotional roller coaster which could potentially lead to poor investment decisions. In addition, a portfolio with 100% stock may take longer to recover after a large drop in the stock market compared to a stock / bond portfolio. Besides maximizing return, one of the investment goals is also to reduce risk of the portfolio. The risk can be reduced by proper diversification of your assets. One of the simpler ways to diversify your portfolio to reduce risk is to add bonds to your portfolio. Because historical data suggests that stocks are more volatile than bonds. At the same time, bonds help limit losses and reduce volatility of the portfolio.

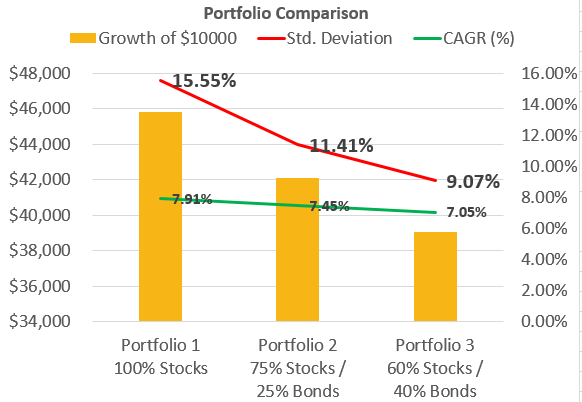

Following is the comparison of three portfolios: 100% stock, 75% stock / 25% bond, 60% stock / 40% bond from 2001 to 2020.

As expected portfolio 1 with 100% stocks gained the most compared to portfolio 2 and 3. However, the standard deviation (SD) for portfolio 1 (15.55%) is significantly higher than portfolio 2 (11.41%) and portfolio 3 (9.07%) indicating portfolio 1 is more volatile compared to portfolios 2 and 3.

In this particular example, adding 25% bonds, reduces volatility from 15.55% to 9.07% while maintaining an attractive return.

2. Bonds Allow Your Portfolio Time to Recover.

Let’s use a drawdown of each portfolio to illustrate the point. The drawdown is the maximum decline from its peak of an investment in a given time period. Following is the maximum drawdown data for portfolio 1, portfolio 2, and portfolio 3 from 2000 to 2020 (Source: Portfolio Visualizer).

| Portfolio | Allocation | Max. Drawdown | Max Drawdown Period | Drawdown Recovered By |

|---|---|---|---|---|

| 1 | 100% US Stock | -50.89% | Nov. 2007 to Feb. 2009 | March 2012 |

| 2 | 75% Stock / 25% Bond | -38.68% | Nov. 2007 to Feb. 2009 | January 2011 |

| 3 | 60% Stock / 40% Bond | -30.72% | Nov. 2007 to Feb. 2009 | October 2010 |

Imagine you need to withdraw money from your all stock portfolio during a large market decline to pay for living expenses in case you lose a job. It would be gut wrenching if you had to sell your stocks after 50% decline in 2008 or 20% decline in 2020.

More importantly, withdrawing money from a declining equity heavy portfolio will have a long lasting negative effect on your portfolio, particularly during the retirement phase. This is called the Sequence of Return Risk.

Since bonds (US Treasury or equivalent) are less volatile in general than stocks, you can use it to withdraw money from your portfolio. Hence, the appropriate bond allocation would allow your equity investment more time to recover.

3. Sometimes Bonds Outperform Stocks!

Although over a longer time horizon (20+ years) historically stocks have outperformed bonds there was a recent 10-year time period when bonds outperformed stocks. For instance, from 2001 to 2010, portfolio 2 (75% stock / 25% bond) and portfolio 3 (60% stock / 40% bond) outperformed portfolio 1 with 100% US stocks.

| Portfolio | Allocation | Initial Balance | Final Balance | CAGR |

|---|---|---|---|---|

| 1 | 100% US Stock | $10,000 | $12,744 | 2.45% |

| 2 | 75% Stock / 25% Bond | $10,000 | $14,453 | 3.75% |

| 3 | 60% Stock / 40% Bond | $10,000 | $15,304 | 4.35% |

How Much Bonds Exposure?

That depends mainly on your risk tolerance and investment time horizon. In general, the longer the time horizon, the higher the risk you can take with your investment. As your time horizon shrinks over time (moving toward retirement), it is a good idea to gradually increase bond exposure. Here is the good resource to review different portfolio allocation models: Vanguard Portfolio Allocation Models.

So if you are in your 20s, you may not need any bond exposure at all since your investment time horizon is a few decades. As you progress in your wealth building journey towards retirement you may need to start adding bonds to your portfolio. For instance, your investment model would change from aggressive growth to moderate or balanced growth. Consider this as a trade-off between your long-term return and an acceptable risk.

Summary

Although bond investment would not produce the same level of income a decade ago due to the current low interest environment, bonds can still play a critical role in your investment strategy. An adequate bond exposure can provide diversification to reduce risk / volatility of your portfolio.

Get our next post in your mailbox.