Market Timing Is Not An Investment Strategy

After dropping more than 30% from its peak in March 2020, the S&P 500 index soared above 3400 in August 2020, erasing its losses during the Pandemic. Yet, the global economic outlook is not promising. The March 2020 downturn in the equity market really tested our risk tolerance. But what to do now? Should we take some money “off the table”? Should we move to all cash and reduce the market risk? If I am on the sidelines, should I wait before “jumping” into the market now? I am a young investor and the market is all time high, what should I do? Ultimately, the question we are trying to answer is: Should I Time the Market? We are going to make the case that market timing is not an investment strategy.

Let’s start with a young investor.

Should A Young Investor Time the Market?

Let’s say you are a young investor in your 20s and ready to invest. However, you are afraid of investing when the market is at an all time high. Should you wait for the next market crash or start investing immediately regardless of market condition?

The short answer is, “invest, invest, invest”, as soon as you can!

Here is the long explanation.

First of all, it is extremely challenging to predict market crashes. Second, if you are in your 20s, you have 30+ years of investment time horizon so time is on your side. Third, your investment in your 20s will be a fraction of your overall nest egg when you reach your retirement age 30 to 40 years from now. Fourth, if stock market history is any guide, equity return over long-term, 10+ years, would be far above the rate of inflation. Finally, waiting will cost you hundreds of thousands.

Waiting will cost you thousands!

Let me convince you with a couple of examples.

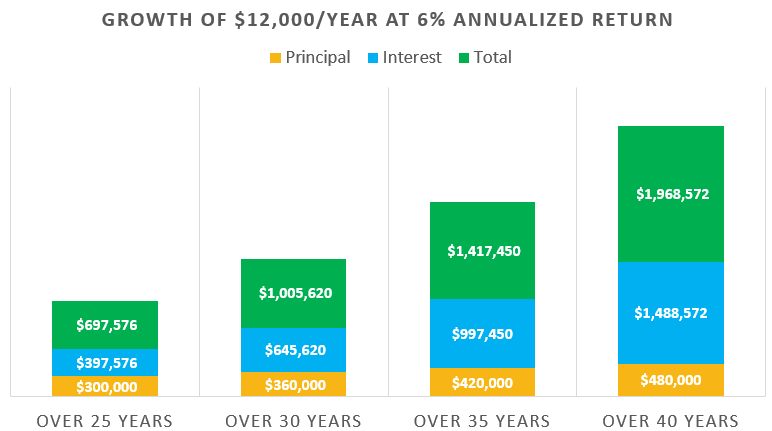

Jo is 25 years old and started investing $12,000 per year consistently over 40 years. Assuming annualized return of 6%, Jo’s account would have grown to almost $2 million!

- Principal Amount = $480,000 ($12,000 per year for 40 years)

- Total Interest = $1,488,572

- Ending Balance = $1,968,572

On the other hand, Mo, also 25 years old, waited until he was 30 years old to start investing $12,000 per year consistently over 35 years. Assuming annualized return of 6%, Mo’s account would have grown to almost $1.4 million! The five years of waiting would cost Mo $600,000!

- Principal Amount = $420,000 ($12,000 per year for 35 years)

- Total Interest = $997,450

- Ending Balance = $1,417,450

Here is the graph of growth of $12,000 per year at 6% annualized return over various time periods.

It is clear that waiting would cost you tremendously! Hence if you are in your 20s, time in the market will truly pay off instead of timing the market. So if I were in your shoes, I would start investing now based on your risk tolerance and financial situation.

What About The Millennial investor?

Let’s say you have successfully built a five to six figure portfolio with a significant gain. You read and heard from various “experts” in the media that the equity market is at its peak and “crash” is inevitable. So should you “lock in” gains by moving all your equity into cash or fixed income, stay on the “sideline”, and “Wait” for next market decline?

Is this a good investment strategy? No! and there are several reasons.

1. “Experts” could be wrong!

That’s right, the “experts” could be wrong!

Several Economists in this article predicted a large market crash in 2017, yet the total return (with dividend) from S&P 500 was 21.8% in 2017.

Robert Kiyosaki, the author of Rich Dad Poor Dad predicted the worst market crash in 2016 in his book Rich Dad’s Prophecy according to this Market Watch Article, yet the total return (with dividend) from S&P 500 was 11.9% in 2016.

Ron Paul, a former House Representative, warned about “a day of reckoning” during a CNBC interview in 2015, yet again the total return (with dividend) from S&P 500 was 1.4% in 2015.

Nobody can predict the future!

2. Market timing could lead to underperformance!

Market timing is not only challenging but it could reduce the rate of return of your portfolio.

When you try to time the market, you have to be right twice; when to get out and when to get back in. Since we are looking in the rear view mirror, it is easier to see the most profitable “entry” and “exit” from the market. However, it is very challenging to execute in real time.

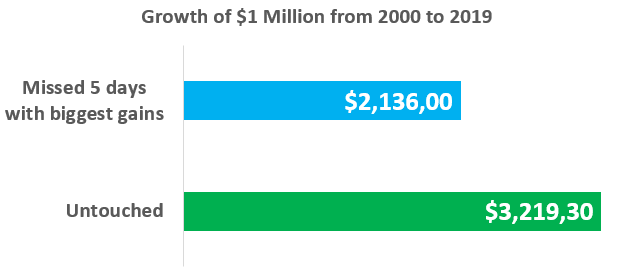

In addition, missing some of the best days of market performance could have a negative impact on your portfolio. According to this study, if you had invested $10,000 and left untouched from 2000 to 2019, $10,000 would have grown to $32,193 (6.02% annualized return). On the other hand, if you missed five days with the biggest gain, during the same period, the $10,000 would have grown to $21,360 (3.87% annualized return). So your portfolio would underperform by 2.15% per year.

The underperformance of 2.15% may not seem like much but it could cost you hundreds of thousands over a longer period of time. The larger the size of the equity portfolio, the bigger the impact. For instance, for a $1 million portfolio, 2.15% underperformance per year amounts to a potential loss of $1.1 million over 20 years as indicated in the graph below.

Now, one can argue from another perspective, staying out of the market during the biggest losses. According to the same study, staying out of the market for the five days with the biggest loss would result in +2.01% annualized gain.

Either way, it is extremely challenging for an average investor to pick the best and/or worst days every year and repeat it for 20 years.

3. You pay more taxes.

If you hold your investment less than one year before you sell it, your capital gain is considered short-term. Short-term capital gain is taxed at ordinary income tax level and you would pay more in taxes if you are in a high federal tax bracket.

According to IRS.gov, the maximum long-term capital gains tax rate in 2020 is 23.8% (20% plus 3.8% net investment income tax (NIIT) if your income is above a certain threshold). While the short-term capital gains tax rate could be potentially 40.8% (37% highest federal tax rate plus 3.8% NIIT). So it is definitely beneficial to hold your investment for a longer period, particularly if you are in a high tax bracket. However, you should review the risk and return of your investment.

4. You are taking on inflation risk.

Although you may have reduced market risk by moving to all cash or fixed income, you are taking inflation risk. The current U.S. Treasury yield is well below the average inflation rate of 2% to 3%. Hence, loss of principal is not likely with the US Treasury 30-Years Bond, it will lose its REAL purchasing power due to inflation.

Besides the four reasons, you may have your best earning years ahead of you. In addition, your investment time horizon may be 10+ years. So, a millennial with a large portfolio should not time the market.

Should A Fearful Investor Time the Market?

Two types of investors fall into this category, the one that would panic and sell during market downturn and the other that would “wait” on the sidelines with a large amount of cash anticipating a crash.

Panic Selling

When you panic and sell during market bottom, you not only lock in the losses but also lose the opportunity of growth during market recovery. Oftentimes we behave this way due to a personal experience, lack of education and/or herd mentality bias.

One of the ways to tame the fear of investing is to educate yourself with financial history and adjust your allocation based on your risk tolerance.

Waiting on the sidelines

You are waiting on the “sideline” with a large amount of cash because you are worried about a market crash. It is a valid concern and the crash might happen after a week, a month or a year after you invest. However, if you have a long investment time horizon (at least 10+ years), waiting will cost you hundreds of thousands as illustrated earlier in this article.

So what should you do? Assuming you have a longer time horizon, you should consider starting the investment process as soon as possible. One approach is to invest by putting all your cash to work immediately, a lump-sum investing. The other approach is to buy a fixed amount at a regular interval, a dollar-cost averaging (DCA). There are numerous studies that would indicate to invest your money immediately. However, if you are worried, at least implement dollar-cost averaging (DCA) strategy and start investing without delay.

So Is There Any “Right Time” to Sell Investment?

Rebalancing

Isn’t rebalancing your portfolio market timing? Well, sort-off. Rebalancing is the process of re-aligning your portfolio to your set allocation. For example, let’s say that your allocation is 60% equity / 40 % bond, according to your financial policy. Due to the bull market, your allocation is now 65% equity / 35% bond. So you will “rebalance” your portfolio by selling 5% of equity and buying bonds. In essence, rebalancing would force an investor to take some profits, in turn, “take some money off the table”. So it is sort of a market timing that allows investors to stick with their asset allocation. Although, it is different from market timing as you are not increasing or decreasing equity exposure from your set allocation depending on market condition.

The concept of rebalancing is simple but is a challenge to implement, in particular, if you have retirement accounts as well as taxable accounts. You have to take tax implication as well as the frequency of rebalancing into account. This is a broader topic that requires longer discussion in the future post.

Tax-Loss Harvesting

One of the reasons to sell your investment at a loss is, if you are planning to take advantage of “Tax Loss Harvesting” to reduce your tax burden. For example, if the price of any of your investments is lower than what you paid for, you can sell the investment at a loss and invest in a “similar” investment type to keep your exposure to the asset class. Although, there are certain IRS rules you have to follow to employ this strategy. Then you can use the loss to offset realized investment gains and up to $3,000 in taxable income. By “harvesting the loss” you save on taxes. Keep in mind, you can only use this strategy in a taxable account. This is another huge topic that we will cover in future posts.

Conclusion

Stay the course!

Decide your asset allocation based on your risk tolerance and stick with it. Try not to make drastic changes to your asset allocation unless it deviates significantly from your financial plan.

As Jack Bogle, the founder of Vanguard Group (world’s largest mutual fund firm) said,

Have you time the market in the past? Will you do it again?