5 Keys to Successful Investing

What is the goal of investing? The ultimate goal of investing is to generate passive income and achieve growth. Income is the interest / dividend / cash flow from your investment while the growth is the appreciation of your investment. Most of us rely on income and growth from our investments to reach our long-term financial goals as saving alone may not get us there. Here are the five keys to successful investing.

- Risk

- Discipline

- Patience

- Time

- Psychology

Risk

How much risk are you willing to take with your investment? The answer is: “it depends”.

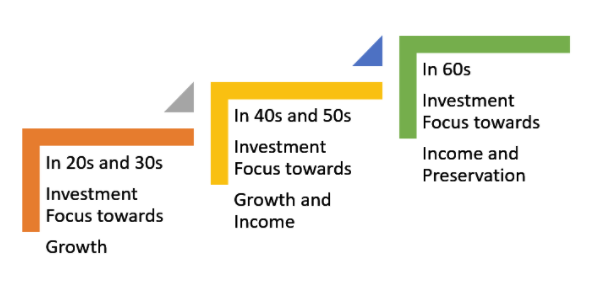

It depends on several variables such as investment time horizon, job stability, savings rate, past experiences, and an appetite for risk. In addition, the willingness to take risk changes with investment time horizon.

For example, investment focus may change from growth to income and preservation of capital as the investment time horizon shrinks.

History

In addition to variables mentioned above, it is prudent to look at the history of the market. History may or may not repeat itself but it provides patterns and trends of the market. For example, based on several decades of the stock market history, anticipate following:

- 5% correction two to three times a year

- 10% correction every year or so

- Bear market (decline of at least 20% from peak of the market) every six years on average according to Fidelity report

Historically, bear markets last shorter than bull markets. In addition, the market has made considerable gains after each bear market. So history tells us that volatility is a regular part of investing. Even with multiple bear markets, from 20% to 80% loss, the general trend of the market is upward.

Consider taking historical trends into account when deciding your risk tolerance.

As Warren Buffett said,

“What we learn from history is that people don’t learn from history. And you certainly see that in financial markets all the time.”

The key is to take the risk early. The longer time horizon gives your investment time to recover from any potential correction.

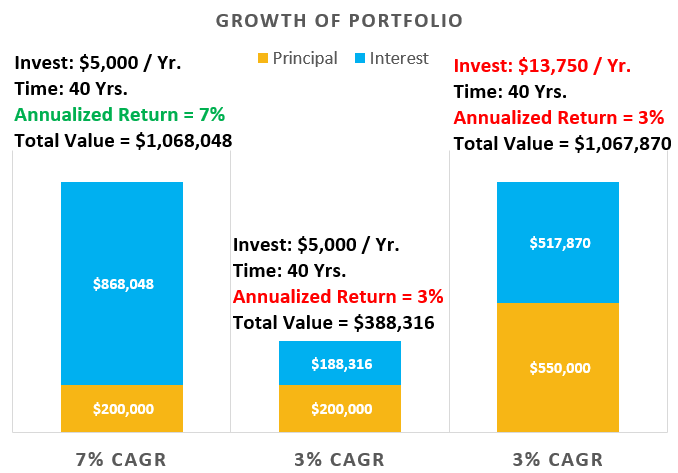

Besides not taking adequate risk early could cost you hundreds of thousands of dollars. For example, the difference in investment growth of $5,000 annually over 40 years earning 7% annualized return vs. 3% annualized return is $679,732 as shown below.

What is the alternative of not taking risk? You need to increase your savings rate considerably. In the above example, you will need to invest 2.75 times more at 3% return to accumulate the same amount of money with 7% annualized return.

Discipline

Our discipline is one of the most important keys to successful investing. It is particularly challenging to maintain discipline during market ups and downs. We are often tempted to let our emotions dictate our decision. Here are some examples.

- FOMO (fear of missing out) leading to buy stocks during market rise beyond our set allocation

- Fear of loss during a market decline leading to sell investment at the wrong time

- Fear of investing during a market decline leading to loss of opportunity

Besides our emotions, sometimes we deviate from our plan by making irrational changes to our portfolio based on short-term forecasts. For example, making a change to your asset allocation based on the next presidential election may lead to poor financial decisions. Remember that timing the market is not an investment strategy.

These decisions often lead to underperformance. Therefore, controlling your emotions by staying disciplined is the key to successful investing.

As Jack Bogle, the founder of Vanguard Group (world’s largest mutual fund firm) said,

Stay the course. Don’t let these changes in the market change your mind and never, never, never be in or out of the market. Always be in at a certain level.

Jack Bogle

Patience

Imagine a person training for a marathon. It is rare to see anyone running a marathon without proper training. The marathon runner has to put some time to build stamina and mental toughness. It usually starts with running a small distance building up to the race. By doing so, the marathon runner is taking advantage of the “compounding effect” of her training. Every mile she had run before the race got her closer to the ultimate goal of finishing a marathon.

Similar analogy applies to investment. Besides consistent investing, you will need patience to take advantage of compounding interest.

As you know compounding interest is the interest earned on the original principal and interest earned on the interest. It is the compounding interest that fuels your investment growth.

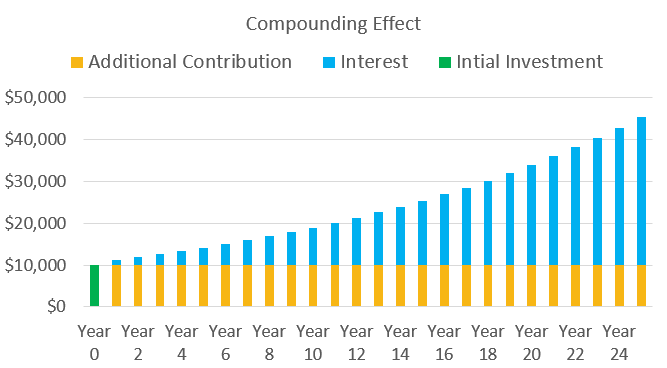

However, it takes several years to a decade to visualize the impact of compounding interest. For example, If you start with $10,000 initial investment and add $10,000 every year for the next 25 years earning 6% annually, it will take several years to realize the impact of compounding.

As shown in the graph, after year 10, interest earned will be the same as the additional contribution amount. The following 15 years, interest earned will keep growing well above annual contribution amount.

Join our blog to receive the excel spreadsheet with compounding interest and other calculations such as future value of money, the rule of 72, retirement funding, and what it takes to accumulate your first million dollars.

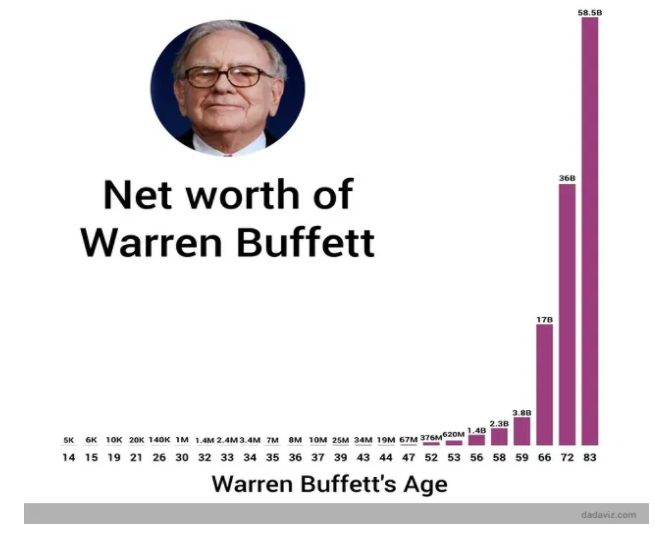

Warren Buffet, The Long-Term Investor

Warren Buffet, one of the most successful investors in history, attributes his financial success to patience and discipline amongst other characteristics of successful investing. He has benefited tremendously from compounding interest. Warren Buffett earned more than 99% of his net worth after age 50. Here is a chart of Buffett net worth milestones (Source: Marketwatch).

The compounding effect is not only available to Warren Buffett. The average investor like you and I can take advantage of the compounding interest in our investment as well. We just need patience as it takes several years to decades to realize the potential impact of compounding interest.

No matter how great the talent or efforts, some things just take time…

Warren Buffett

Time

Along with patience, starting to invest early makes a huge impact on investment decades later. Let’s compare investments for two individuals. Ann started investing $5,000 every year from age 25 until she is 65. While Dave waited until age 35 and started investing the same amount until he is 65.

Starting 10 years late will cost Dave $400,000. The biggest difference between the two is the compounding interest.

Investor Psychology

Behavioral finance focuses the psychology of investors’ decision making. Oftentimes, investors do not make rational decisions because of behavioral biases. Some of the most common behavioral biases are loss aversion and herd mentality.

Loss aversion means focusing more on avoiding a loss than on making gains. For example, the fear of losing money preventing an investor from entering the equity market for years, resulting in a loss of opportunity.

Herd mentality: Our behavior and decision making are influenced by other investors and media. For example, an investor may start selling during a market downturn because everyone around him is selling.

Even after educating ourselves, learning to be patient, giving our investment time, and understanding the benefits of “staying the course”, we tend to make irrational decisions because of our own behavioral biases.

For example, we stay on the sidelines in fear of losing money or sell investment at the wrong time because everyone around us is doing it or taking more risk beyond our appetite. Think of your behavior during 2001-2002, 2007-2008, or March 2020 market crashes. Were you the victim of any behavioral biases?

This is one of the most challenging aspects of long-term investing.

When you are faced with an adverse decision, “slow your thinking” to improve decision making as suggested by Daniel Kahnermann.

If you interested in reading more about behavioral finance, check out Daniel Kahnerman’s Thinking, Fast and Slow. Daniel Kahnerman is one of the founding fathers of behavioral finance.

Understanding these behavioral biases and controlling what you can is key to successful investing. Investor psychology is a much longer discussion and we will cover it in a future post.

Summary

Taking adequate risk, staying disciplined, being patient, and understanding our psychology in financial decision making are the key aspects of successful investing. We cannot control the direction of the interest rate or the next bear or bull market or the state of the economy. So, we should focus on what we can control for long-term investment success such as our savings rate, investing consistently, taking adequate risk, diversifying our assets, rebalancing as required and keeping the cost low.

Very well explained.

Thank you Tanvi.