Should You Expect A Santa Claus Rally?

Oh, finally it is the time of that year. Spending time with family, sharing meals with loved ones, visiting families, in general, feeling of happiness and optimism during the December holidays. The holiday spirit in the investment world is coined as a “Santa Claus Rally”. A Santa Claus rally in the stock market refers to the rise of the market in the last five trading days in December and the first two trading days in January in the following year. The term was first recorded by Yale Hirsch in the Stock Trader’s Almanac in 1972. Should we expect a Santa Claus Rally in 2020?

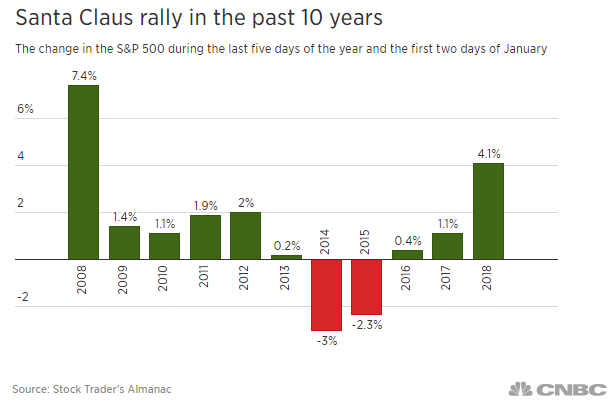

According to the Stock Trader’s Almanac, the S&P 500 has generated positive returns 79% of the time since 1950 during the Santa Claus rally. And an average increase in the S&P 500 is 1.3% since 1950. Following is the graph representing the change in the S&P 500 during the Santa Clause rally from CNBC.

What Contributes to Santa Claus Rally?

There are few events that may lead into generating positive returns during the last five trading days in December and two days the following January such as

- Thanksgiving and Black Friday Shopping

- Cyber Monday Spending

- Holiday shopping leading up to Christmas

- General optimism during holidays

- Year-end portfolio restructuring

- Investing potential year end bonus

What Should We Do?

- Maximize your contribution to 401(k).

- You can contribute up to $19,500 in 2020; if you are 50 or older, there is an additional $6,500 catch-up contribution. The deadline for contribution is the end of the calendar year.

- Maximize your contribution to Traditional IRA

- You can contribute up to $6,000 in 2020; if you are 50 or older, the contribution limit is $7,000. Unlike 401(k), you have until your tax filing deadline.

- Take advantage of Tax Loss Harvesting Opportunity

- You can use tax loss harvesting to reduce your tax burden in a taxable account.

- Rebalance Your Portfolio

- Rebalancing is the process of re-aligning your portfolio to your set allocation. For example, let’s say that your allocation is 60% equity / 40 % bond. If your allocation is now 55% equity / 45% bond then you would “rebalance” your portfolio by selling 5% of bonds and buying stocks.

- Consider giving to charity

- Besides helping people in need, making charitable donations before December 31 may reduce your tax burden depending on your income and itemized deductions.

Summary

Although historical data suggests that the market had generated positive returns 79% of the time since 1950 during the Santa Claus rally, timing the market is not an investment strategy. Consider sticking with your long-term investment plan instead of making any drastic changes to your asset allocation.

Get our next article in your mailbox.