Saving for Retirement Using the Engineering Equation!

In this post, I will be demonstrating how the process of saving for retirement is analogous to the engineering equation! As with any engineering analysis, firstly, we will start with a problem statement. Secondly, we will review variables. And finally, we will review the end result.

Problem Statement

So here is our problem statement: Accumulate enough money to retire comfortably.

Let’s define our problem by determining how much money is enough to retire? Of course, that depends on the individual and lots of other factors, in particular, your expected expenses in retirement and your withdrawal rate. But let’s keep it simple for illustration purposes and use the 4% rule (Trinity Study) to estimate the retirement goal.

Let’s assume that your estimated expense in retirement is $60,000 per year. Applying 4% rule, you will need

$60,000 / 0.04 = $1,200,000!

So our goal is to accumulate at least $1.2 million dollars.

Saving for Retirement Using Engineering Equation

Let’s solve this problem with the first equation I learned in Chemical Engineering, the conservation equation. The material or mass conservation equation in its simplest form is

Accumulation = In – Out + Generation – Consumption

Let’s define each term,

| Variable | Engineering Term | Investment Term | Add or Subtract to Initial Balance |

|---|---|---|---|

| In | Material Flowing in | Deposits | Add |

| Out | Material Flowing Out | Withdrawals (check, payment, ATM) | Subtract |

| Generation | Occurs due to Chemical Reaction | Investment Earnings | Add |

| Consumption | Occurs due to Chemical Reaction | Investment Fees | Subtract |

So Starting with initial balance, deposits will be added to initial balance, and withdrawals will be subtracted from the remaining balance, to arrive at the final balance. Note that generation and consumption will also affect the final balance. The difference between the final balance and initial balance is the accumulation.

The accumulation can either be zero or positive or negative! In engineering terms, a system which does not accumulate is said to be at steady-state. Well, you do not want to be in a steady-state situation nor you want accumulation to be negative. You want accumulation to be positive.

The Variables

The “In” = Deposits

For most of us, the “in” is in the form of earned income. Higher earned income at an early stage of your career will give you an advantage in compounding your savings. So keep it flowing! While for a few lucky ones, the deposit may be in the form of inheritance or lottery winning!

The “Out” = Expenses

Higher expenses will reduce your accumulation amount so you want to control your expenses to make sure your accumulation is “positive”. You may consider living like a college student for a few years after graduating by controlling the largest spending categories such as rent and transportation. For example, cut down your rental costs by sharing an apartment and drive the same old car you used in college for a few years. This will allow you to save more of your income for investment resulting in positive accumulation. Living below your means is necessary to control “the out” variable.

The “Consumption” = Fees

The “consumption” would be fees, mainly investment related fees such as the expense ratio of a mutual fund, financial advisor fees, trading fees, and bank charges. As fees would reduce your final balance overtime, it is best to minimize them as much as possible by becoming a Do-It-Yourself (DIY) investor. One of the best resources to educate yourself is The Bogleheads’ Guide to Investing by Lorimor, Lindauer, and LeBoeuf. This book is for anyone who wants to learn how to invest money on their own (Do-It-Yourself, DIY investors). The book provides guidance toward simplistic investment strategies.

The “generation” = Compounding

In terms of conservation equation, generation occurs from chemical reactions. The rate of reaction can be accelerated using catalysts. So think of compounding interest as your catalyst that accelerates your investments. However, you will have to allow more time for the “catalyst” to work and grow your investment. Therefore, consistent saving and investing from early in your career will play a major role in the accumulation of your wealth.

Now that we are familiar with the four variables, let’s see how much we have to save to reach the retirement savings goal of $1.2 million dollars.

The Result

Remember our goal of saving $1.2 million dollars for retirement. So how much do we have to save every year (positive accumulation) to reach the goal? We will use the “Future Value” (FV) equation in excel to determine yearly contribution rate.

Based on the following assumptions:

- Contribution per year: $12,000 (assuming 20% saving rate of your $60,000 salary)

- Investment return: 6%

- Investment Time Horizon: 35 years

- Current Savings: $0

The Future Value of your investment will be $1.3 million dollars!

Here is the breakdown of Future Value. Notice the compounding interest (the “generation”), it is more than double the total contribution amount.

- The contribution: $420,000

- Compounding Interest: $917,217

- Total Ending Balance: $1,337,217

The total ending balance above our goal as indicated under the Problem Statement section above!

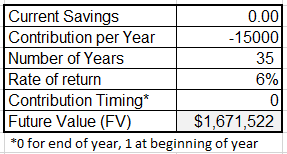

Once you set this up in excel, you can play with different variables to determine future value. For example, let’s say instead of 20% of your $60,000 salary, you decided to save 25% of your salary. Assuming all other variables are the same, the future value of your investment would be:

Summary

As you can see, saving for retirement is analogous to the engineering equation. It is all about controlling variable. For instance, in terms of investing, you have to control two variables: income and expenses. Firstly, you have to make sure “in” (earned income) is more than “out” (expenses) to ensure that accumulation is positive. Secondly, give your “catalyst” (compounding effect) longer residence time (investment time horizon) to accelerate your investments. Finally, keep the investment fees to minimum. In summary, start saving early, invest consistently, and let compounding help you build your wealth.

Have you set your retirement savings goal? Which of the four variables is a challenge for you to control?

Very nicely put in engineering language👍🏼

Thank you Tanvi. It was fun writing it. I got goose bumps going back to conservations of mass equation :- )